D2C companies seem to have access to deep pockets despite the funding winter.

“Large conglomerates are finding it easier to buy out direct-to-consumer (D2C) brands amid a funding crunch for unprofitable startups… [They] are realizing that they are missing out on the fast-growing D2C space…acquiring D2C startups gives them access to digital capabilities, new-age brands, as well as a team.”

Abha Agarwal, executive director, and co-head, of Avendus Capital.

Why you should think bigger

Pandemic hit. Both consumers and businesses suffered.

The creator-consumer found ways to monetize products, services, and practices with digital capabilities on steroids and peer-to-peer networks that have a stethoscope on the beating heart of their end-consumers. For monolithic DTC or FMCG brands, it was either go digital or go extinct.

Early-stage brands that start off selling from their homes, make it go online or omnichannel off retail shelves and e-commerce stores, and can eventually think of expanding capabilities to attract bigger shark in the FMCG sector by selling out. There’s an expansive white space for the two to explore.

Shark Tank 2021

2021 was a pivotal year for the Indian venture capital (VC) investment landscape, per a report by Bain and Company (2021), the share of VC funding in India accounted for greater than 50% of overall private equity and VC investments in the country in 2021.

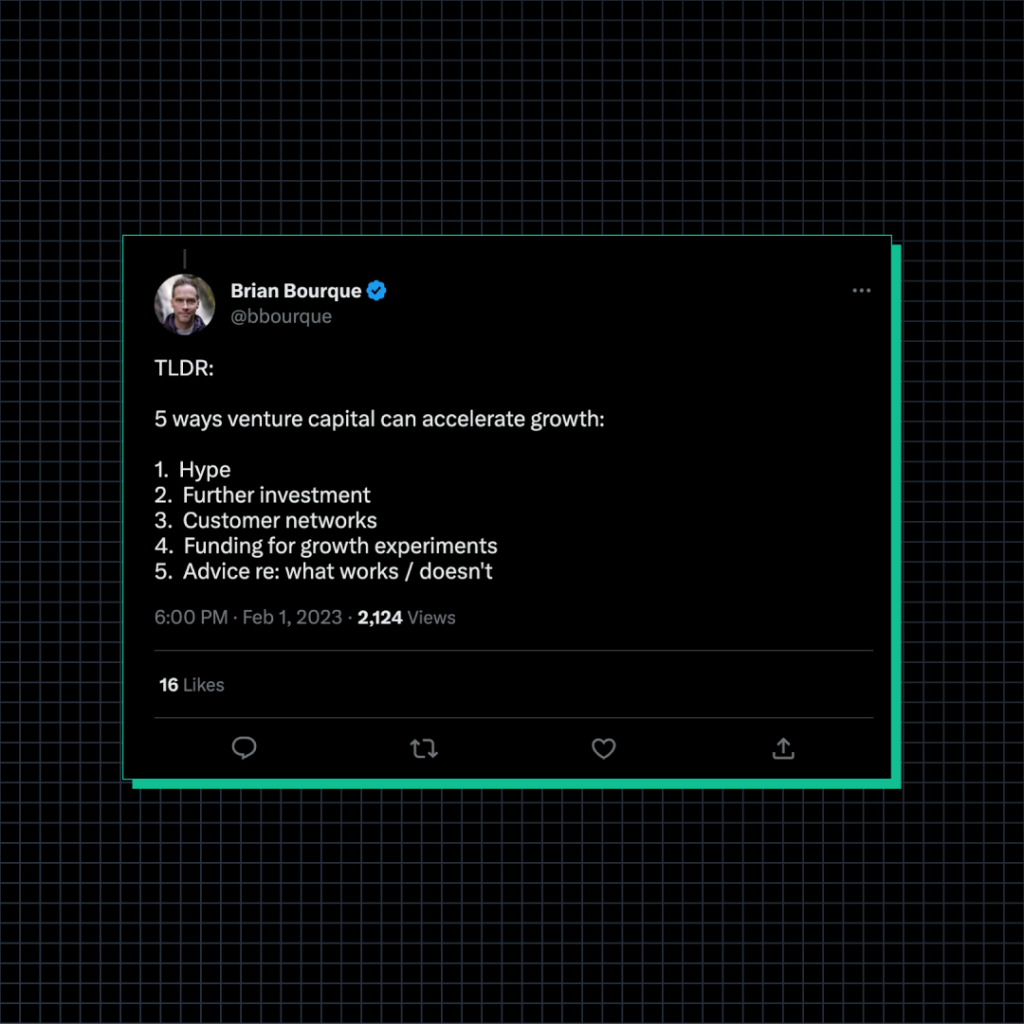

It is essential to understand the reason for raising funds. Raising from an institutional investor is not just about the money: it’s about the growth appetite, social networks, knowledge, and expertise that you have access to. It opens access to an entire ecosystem, often difficult to reach for fresh entrepreneurs. But, sometimes companies setting daily, weekly, and monthly records win regardless of their backing. Shark Tank has been a show that has shown both sides of this example and is a large collection of learning material to see what fits and what doesn’t.

At the time that week 2 finished airing, the sharks had all together invested nearly INR 18 Cr into multiple businesses.

Last season which aired in 2021, 67 out of 198 pitches got funded raising about INR 42 Cr.

The Show

When companies get on Shark Tank, they are also selling their brand story to those tuned in. There’s flair and drama. And an undeniable edge they carry even if they don’t close a deal.

JhaJi Achaar

A popular example. JhaJi Achaar. An online homemade pickles store that uses authentic, traditional recipes from Mithilanchal in the North-Eastern region of Bihar. They employ underprivileged women and contribute 2% of their revenues to girl child education. They didn’t get a deal in the first season, season 2 began with Vineeta and Namita writing them a cheque for INR 85 L, an investment from them and Jharkhand Angels for 8.45% equity.

The story touched everyone, and 3 months of sales were done in 1 night, selling INR 25 L within 24 hours. The women founders also received a lot of love (and even funding offers) on social media for their ideas, efforts, and the pitch.

National Bureau of Economic Research, US, reports that “increased media exposure to entrepreneurship nudges individuals down the path of launching a business, even if stronger nudges are required to increase new business formation.”

In Asia, a study on Shark Tank Vietnam found that the more innovative a product was, the more popular it gets, along with “sharks in the show providing a substantial amount of funding, which is highly comparable to that of the largest funding program for innovation by the Vietnamese Government.”

The Stories

Paradyes

The show has seen some notable stories which are great business lessons of all sorts. An unlikely company that made noise was Paradyes, who claim to be India’s first semi-permanent hair color brand. They asked for INR 65 L for 1% equity. Paradyes left the sharks impressed with a robust supply chain and on-brand marketing – dubbed a ‘category-creation business’ by Peyush Bansal.

After receiving multiple lucrative offers, the founders requested INR 65 L for 3% equity, but from Vineeta Singh and Aman Gupta specifically. Gupta offered more than money to the founders. “We’re here to support you. In no other category has an Indian brand pushed out foreign brands from the Indian market but we (boAt) have. We know how to fight them. Now decide, if you need value or valuation!” commented Gupta. At the end of the show, the startup’s valuation zoomed from INR 13 Cr to 32.5 Cr.

Here, we see a lesson in knowing that when you accept an investment, it’s more than the money; you enter into a partnership. Paradyes founders received many lucrative offers but accepted a lower offer to bring the right sharks into their company – Vineeta Singh and Aman Gupta. Additionally, investors want to invest in not just a winner but the winner. The best success case needs to ideally result in you dominating the market, not sharing it.

The co-founder, Yushika Jolly, took to LinkedIn to talk about how the episode was received, highlighting how sales doubled on their website, along with a 20x spike in traffic. “All in all, I believe that being on Shark Tank will change the game for us and cause you to see us much more frequently moving forward,” she says.

Moonshine Meadery

On the other hand, Moonshine Meadery, officially set up in 2018, came on in the first season of Shark Tank, valuing themselves at INR 160 Cr. It is the first mead in Asia and India, set up by Rohan Rehani and Nitin Vishwas. Founders asked for INR 80 L in exchange for 0.5% of the company’s shares, yet received an offer of Rs 1 Cr for 2.5% of their firm, with all the sharks coming together eventually on the 2.5% – a rare occurrence.

Yet the deal was rejected by the founders. Drama ensued on the show, with Anupam then tearing the check they had prepared. The brand then saw 2 L visitors on its site in a span of 2 hours after the episode was aired. Moonshine is currently in expansion mode, having reached all the way to Dubai! Here is a key lesson in really knowing what your company is worth. When the effort and expertise that you work within the business outweigh the benefits you would get on evaluation, it is fine to say no, even if it’s counter-intuitive. You know your products better than everyone else. It’s important to evaluate the options without worry, and know that there are alternatives.

Sunfox Technologies

An all-shark deal that ended up being accepted from season 1 was Sunfox Technologies, which invented a portable ECG device, Spandan that the patient can use at home. This device can help many prevent irreversible heart ailments by making an early diagnosis. It received a total investment of Rs 1 Cr for 6% equity from all the Sharks, having asked for INR 1 Cr for 2% equity. Anupam later took to Instagram to share that the company’s sales had grown 5x since Shark Tank India.

Hoovu Fresh

One of the most seamless pitches was from the unlikely brand Hoovu Fresh, which aims to extend the freshness of flowers to 15 days. Led by Rhea Karuturi and Yeshoda Karuturi, they came up with the idea of packaging the flowers and delivering it to the doorsteps of homes and temples. With coverage that spans 8 cities and 500 farmers, the concept seemed ripe for the taking. While the sharks initially wondered about the growth of the brand, the founders held their ground and explained how the business could grow, valuing themselves at INR 80 Cr, having earlier raised INR 3.5 Cr at a valuation of INR 50 Cr. The founders then went ahead with Aman Gupta and Peyush Bansal’s offer of INR 1 Cr for 2% equity.

The importance of understanding and developing tech for your company shines bright here. There wasn’t an idea for a machine for storing and packaging flowers in such a way. “In the beginning, when I used to show the designs to the vendors, they would often dismiss it. But we got lucky with a local vendor who agreed to try one of our designs. After that, we built our first machine,” Rhea Karuturi shared in an interview.

Flatheads

Another story was that of Flatheads, a natural-fibers shoe company by Ganesh Balakrishnan, which was circulating everywhere.

With just enough runway left for a few months, the show saw the previously fairly-successful Balakrishnan come to terms with the fact that his business might not be viable in the short term (due to low sales after the COVID-19 lockdowns since no one was buying shoes), with all the sharks encouraging him to rethink his strategy not only to work but with life as well.

After the episode aired, Balakrishnan put a Linkedin post about his experience and his decision, also adding that inventory was sold out in India! The pitch was a great example of how to not take rejection from investors personally, while also learning to trust yourself.

A study in the Journal of Global Entrepreneurship Research (volume 11, 2021) explored 105 articles on survival tools that could be applicable particularly during the setting-up of entrepreneurial ventures as well as in the course of difficult economic periods. They discovered that early control is important to prevent a larger crisis. Additionally, building relationships through collaboration and social networking could offer start-ups a lifeline to get social capital. “Sustainability of any entrepreneurial start-ups is a cumulative effect from the existing and new product(s) and process(es) aspects.”

How to win as a D2C

Indian Shark Tank is less cut-throat than Shark Tank America. Each shark runs their own company with full-time jobs, unlike their American counterparts who have enough skin in the game and make long bets on ambitious brands. But that does not discount the value, networks, and expertise they bring to the table. Shark Tank or no, winning as a D2C is based on fundamental business principles of leading with value.

As every business pulls their heads from the clouds and builds things that people will buy in a downturn, the war chest of visibility that once worked no longer does. Search, socials, content, sales funnels, review sites, trust badges, lead magnets, and clunky machinery that not all startups may have the resources or bandwidth for.

As the web advances with your growth story, it’s clearer than ever that your customers deserve the limelight beyond the sales, marketing, sales, success stories, social mentions, or even their lifecycle with your product. Besides, not every kirana or small business can code, gamify, run GDN, Twitter, or Meta ads that prove useful or integrate AR/VR experiences in their e-commerce stores.

Recession-proofing: Roadblocks to turn in your favor

1. Too little trust, loyalty, or interactions among early adopters

In the glocal village, customer engagement is both online and offline. General and selective. Binary outbound strategies are a decade too old. Referrals, user-generated campaigns, pan-India crowdsourced campaigns, and permission-affiliate marketing incentivize everyone in the product ecosystem to buy and spread the word.

2. Brand recall through the clutter

Your brand story should exist beyond your e-commerce website in the minds of your customers. Amazon undermines any brand recall cues you attempt to set up in your A+ listings. Besides, 42% of reviews on Amazon are fake. There’s an unmistakable shift from catch-all advertising to personalized campaigns that are human and tech-enabled. Besides, anything you do to capture value from the customer has to be privacy-positive, putting buying back into their hands agnostic of channel, app, or industry.

3. Customer churn

There’s no time for parlor tricks post-COVID. The consumer is very conscious of what their consumption patterns are perceived as among peers. Unsuspecting users are also bombarded with social media content, ads, emails, sales pitches, and other interruptions. The Harvard Business School claims that on average, a 5% increase in customer retention rates results in a 25–95% increase in profits. Your best bet? Control what you can and de-risk what you can’t. Namely, analytics via first-party cookies, hyper-local cohorts that you can drive via trust, loyalty, and interactions with micro-influencers, social proof, and community-led growth that put the limelight back on your brand story.

4. Straddling multiple metrics through different stages of growth

Of course, community-led expansion is slow but sure. As you attract bigger sharks the cornerstones of Product, Price, Promotions, and Place are key indicators of business health.

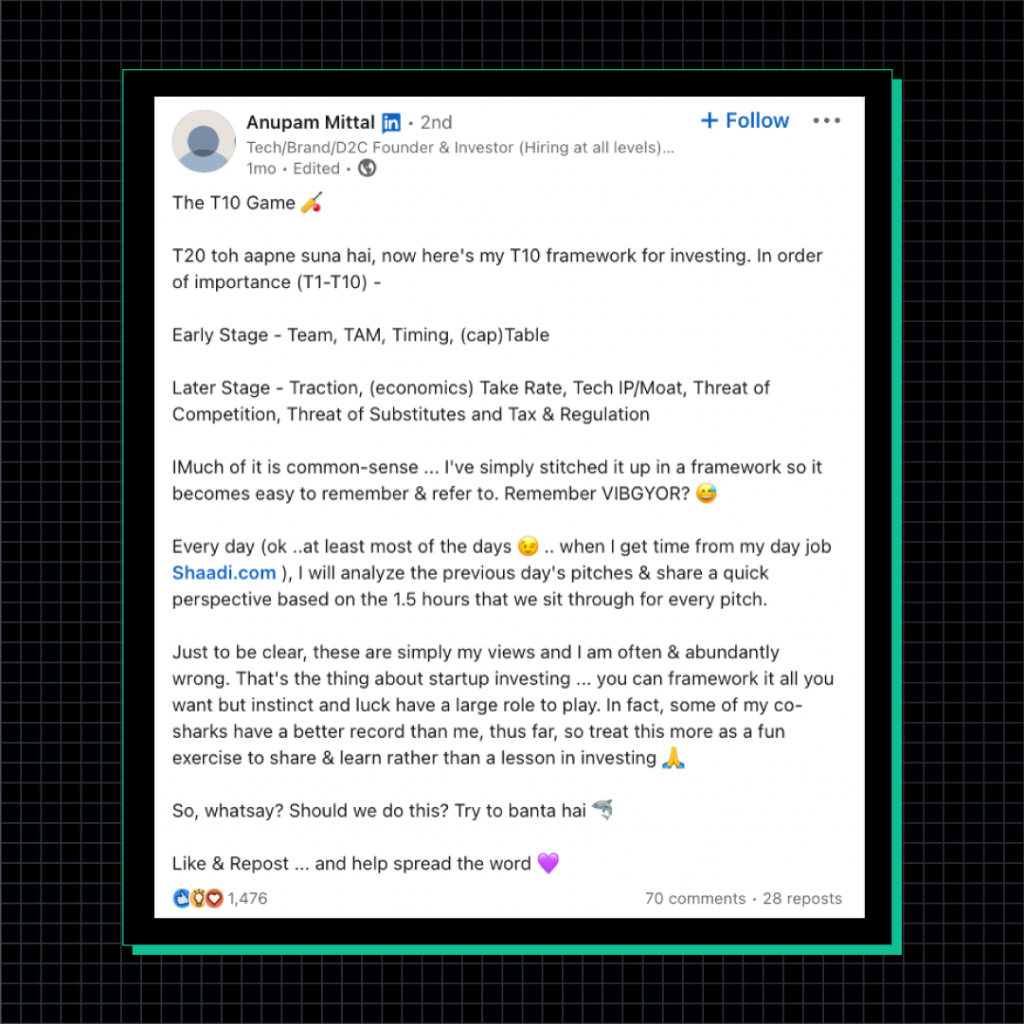

LTV/CAC of 3x is good but great companies get to 5x or more. Figure out the metrics that signal disciplined growth for your industry. Here are Anupam Mittal’s heuristics:

Contextualization

The new customer has more knowledge and power than ever before. Gone are the days in which the customer had to depend on only a couple of brands for their needs. KPMG reports that each of the customer-facing roles, marketing, sales, and support, will continue to evolve in tech, processes, and organizational design:

Trends to watch:

- Businesses and consumers as equals who co-create, co-decide, and co-test solutions

- On-demand deliveries across multiple channels for contextual experiences

- Relevant, real-time interactions that celebrate customers throughout the year

- Simple, seamless experiences at every touchpoint

“Continuous disruption is the new normal. It is not enough to get ahead of the Connected Customer, the more profound challenge is staying ahead. New technology, process, and organizational changes must embed an anticipatory stance.”

Personalization

Personalized value demands stripping away everything unnecessary. And going down to basics: unit economics, customer acquisition cost, and lifetime value.

If intermediaries like third-party sales and cookies, traditional marketing, and reactive support functions have to go, so do ads and spray-and-pray campaigns, long-winding supply chains, brute force sales, and apologetic support teams outsourced to a third-world country.

Instead, there are higher-order brand values like ESG goals and hyper-personalization with first-party cookies across devices. The ‘awokened’ consumer knows exactly what they want, how they want it, and when they want it. With the smartphone, this creator-consumer in turn becomes your prime evangelist. This is what makes your go-to-market more textured personalization. And this is exactly the kind of stuff venture money and clunky monolithic organizations are after.

The limits to AI/ML, AR/VR, social shopping, omnichannel experience, fin-tech ecosystem partners, and more nimble supply chains are left to be tried over time. Fads and buzzwords are great indicators of overarching trends. Trends are more subliminal patterns that signal a retail future that’s more human, secure, relatable, and personal.

On failing despite venture capital

Unlikely advice: How to pick investors and pitch

1. Finding the right investors

Do your homework on what you’re building, why you will win, de-risking the business, and what success implies for the investor’s future portfolio. For this, strategic long-term partnerships with the right investors are crucial. The experience, connections, and knowledge of your investors contribute significantly to your trajectory.

2. Pipeline and build relationships

Not all investors are the same. The principles of recruiting apply here. You need to be talking to multiple investors at the same time. And this gives you the bargaining chip to create FOMO and engineer the competition your company deserves. Saying you’re not fundraising is one of the best things you can possibly say to an investor. So when you’re making warm intros or cold shoutouts, it takes the load off them while listening to you.

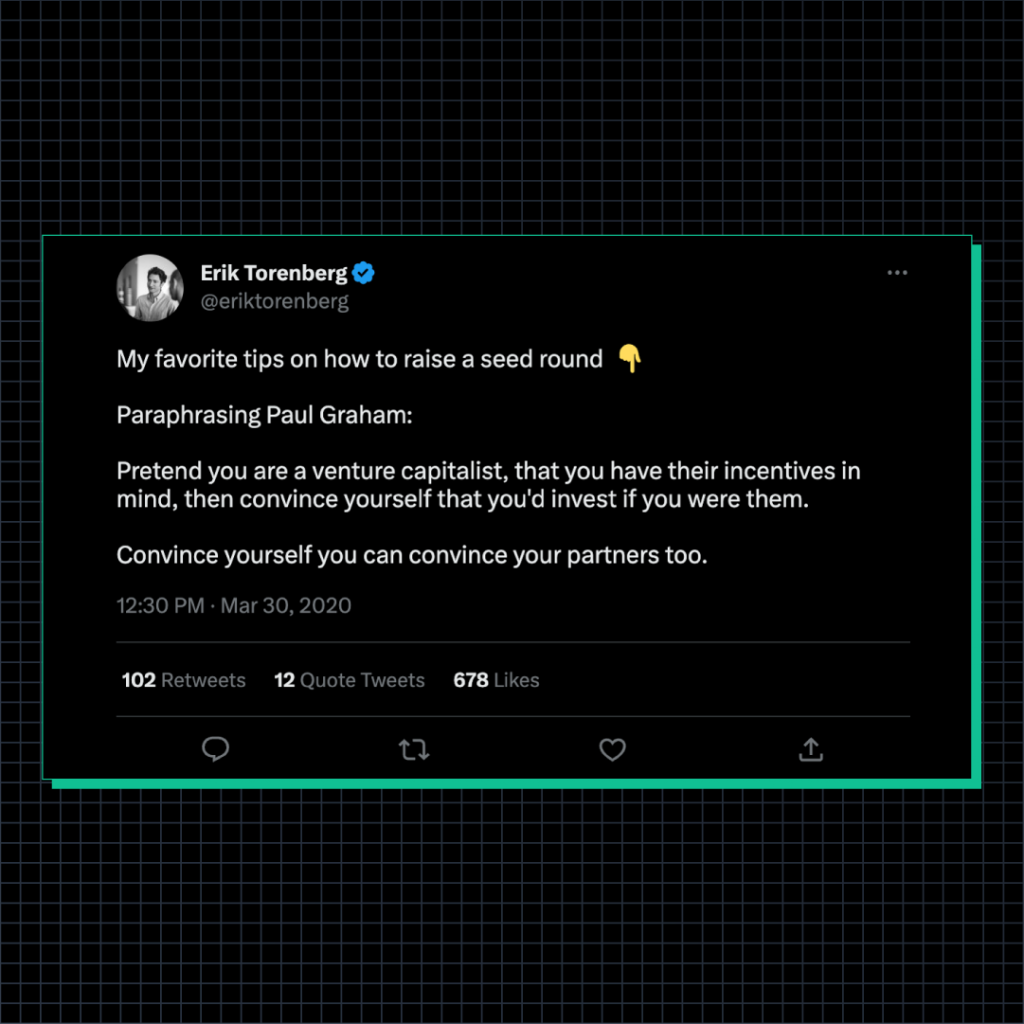

3. Craft and time your narrative

When crafting your narrative, use your networking field of play as an experimentation ground. Crisp elevator pitches, some behind-the-scenes slides of progress you can frame, calculated opinions delivered smoothly, absolutely no arbitrary KPIs, and slide in venture scalability. You are in control of your fundraising timing. It’s best to do it when you’re confident you can act with momentum and raise funds quickly. After that, it’s only a matter of time.

Seasoned advice on how to pitch

In closing

No matter how innovative and well-thought-out your idea is, your prospective investors aren’t going to take your word for it. You need to demonstrate to them that investing in your startup is likely to provide them with a good return on their investment.

Venture capitalists pass by successful startups often. This isn’t necessarily a reflection on the company or founders. Even Y-Combinator, which backs companies like Airbnb, Coinbase, and Cruise, explains that there are only so many strategic investments they can make per batch.

If your pitch doesn’t succeed this time, it’s still a win if you had a mike in front of you while under the scrutiny of people who’ve been there and done that. Conversely, your company could be doing well enough to not require funding as well. Much like this season’s Bhaskar’s Mane Holige.

Keep doing the work. Use platforms like Shark Tank to study and perfect your pitch. And you’ll know what to do.